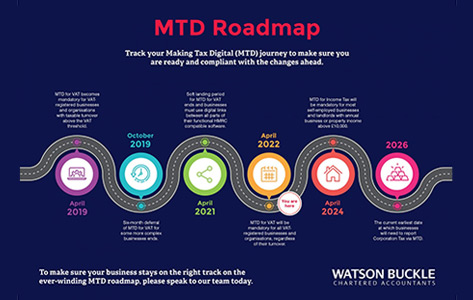

Making Tax Digital (MTD) is the single biggest innovation in tax reporting businesses and the self-employed have seen. Whether you have decided to embrace it or hate it, uptake of the scheme is now mandatory for almost all companies.

All VAT registered businesses and self-employed workers, regardless of their turnover are now required to file, pay, and update their VAT information online each quarter, using HM Revenue & Customs compliant online accounting software or the tax authority’s own API using bridging tools.

Do I have to comply with Making Tax Digital?

All VAT-registered businesses and the self-employed must now comply with MTD for VAT from April 2022 and could face penalties if they do not follow the requirements of this tax recording and reporting scheme.

From April 2024, landlords and self-employed businesses with annual business or property income above £10,000 will need to follow the rules for MTD for Income Tax, which will also require them to complete quarterly reports using compliant software.

This will be followed in April 2025 with a requirement for general partnerships to follow the same rules, followed by new rules for MTD for Corporation Tax that are expected to come into force in 2026.

Need help?

We have been assisting a wide range of businesses with their preparations for MTD and can help you find the right systems and solutions to ensure compliance, while also giving you access to the latest insights and information about your business.

With the potential for penalties for non-compliance, it is important that you act quickly if you aren’t currently following the requirements of MTD.

Are you ready? Get ahead of the pack and use Cloud Accounting today.

With Watson Buckle, taking on Making Tax Digital is as easy as 1, 2, 3.

Get in touch

Register your interest today by clicking here.

Engagement

We’ll pair you up with a cloud accounting expert and learn more about your business needs

Set-up

We’ll set you up on software that suits you, and offer unlimited aftercare support.